us japan tax treaty article 17

And the potential impact of such changes to companies doing business between the US and Japan. Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income signed at Tokyo.

Changes To The Us Japan Tax Treaty International Tax Accountant

Article 17 of the US-Japan Tax Treaty clearly states.

. Article 15-----Income from Real Property Article 16-----Capital Gains Article 17-----Independent Personal Services Article 18-----Dependent Personal Services Article 19----. Although the Protocol was signed on 25 January 2013 and approved by the Japanese. The provisions of Articles 14 15 16 and 17 shall apply to salaries wages and other similar remuneration and to pensions and other similar remuneration in respect of services rendered.

Us japan tax treaty article 17. Any other United States possession or territory. Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security.

Us japan tax treaty article 17. Article 17 of the US-Japan Tax Treaty clearly states. The problem is that in the US-Japan Tax Treaty as with most other tax treaties private pensions and annuities are not excluded from the Saving Clause and since the US taxes US.

ISSUES RELATED TO ARTICLE 17 OF THE OECD MODEL TAX CONVENTION INTRODUCTION 1. Relief From Double Taxation. Tax Information Exchange Agreements.

A the term Japan when used in a geographical sense means all the territory of Japan including its territorial sea in which the laws relating to Japanese tax are in force and all the. Paragraph 1 - Pensions and other similar remuneration including social security payments beneficially owned by a resident of a. If the treaty does not cover a particular kind of income or if there is no treaty between your country and the United States you must pay tax on the income in the same way and at the.

In general the tax treaty allocates or restricts taxing rights between the two countries so that a resident of either the United States or Japan does not pay tax in both countries with respect to. Therefore if a US person earns. Article 71 of the United States- Japan Income Tax Treaty states that profits are taxable only in the Contracting State where the enterprise is situated unless the enterprise carries on.

2013 Technical Explanation of Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance. Tax Conventions principally for the elimination of double taxation and the prevention of tax evasion and avoidance 2. Background the long road to ratification A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of instruments of.

In other words the double taxation relief allows a person to claim a. Entry into effect a the provisions of the mli shall have effect in each contracting. Relief from Japanese Income Tax and Special Income Tax for Reconstruction on Not Expressly Mentioned in the Income Tax Convention APPLICATION FORM FOR REFUND OF THE.

Under Article 17 of the OECD Model Tax Convention the State in which the activities of a non. Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments. As of August 8 2022.

Security taxes to both the united states and japan for the same work.

Japan The Emergence Of Imperial Japan Britannica

U S Tax Treatment Of Chinese Mandatory Individual Accounts And Social Insurance Pensions Castro Co

Latin American Tax Treaties A Regional Overview Htj Tax

What Is The Uk Portugal Double Taxation Treaty Rhj Accountants

Japan Tax Income Taxes In Japan Tax Foundation

Simple Tax Guide For Americans In Japan

Form 8833 Tax Treaties Understanding Your Us Tax Return

Changes To The Us Japan Tax Treaty International Tax Accountant

Roth Ira Taxation For Expats In The Uk Expat Tax Professionals

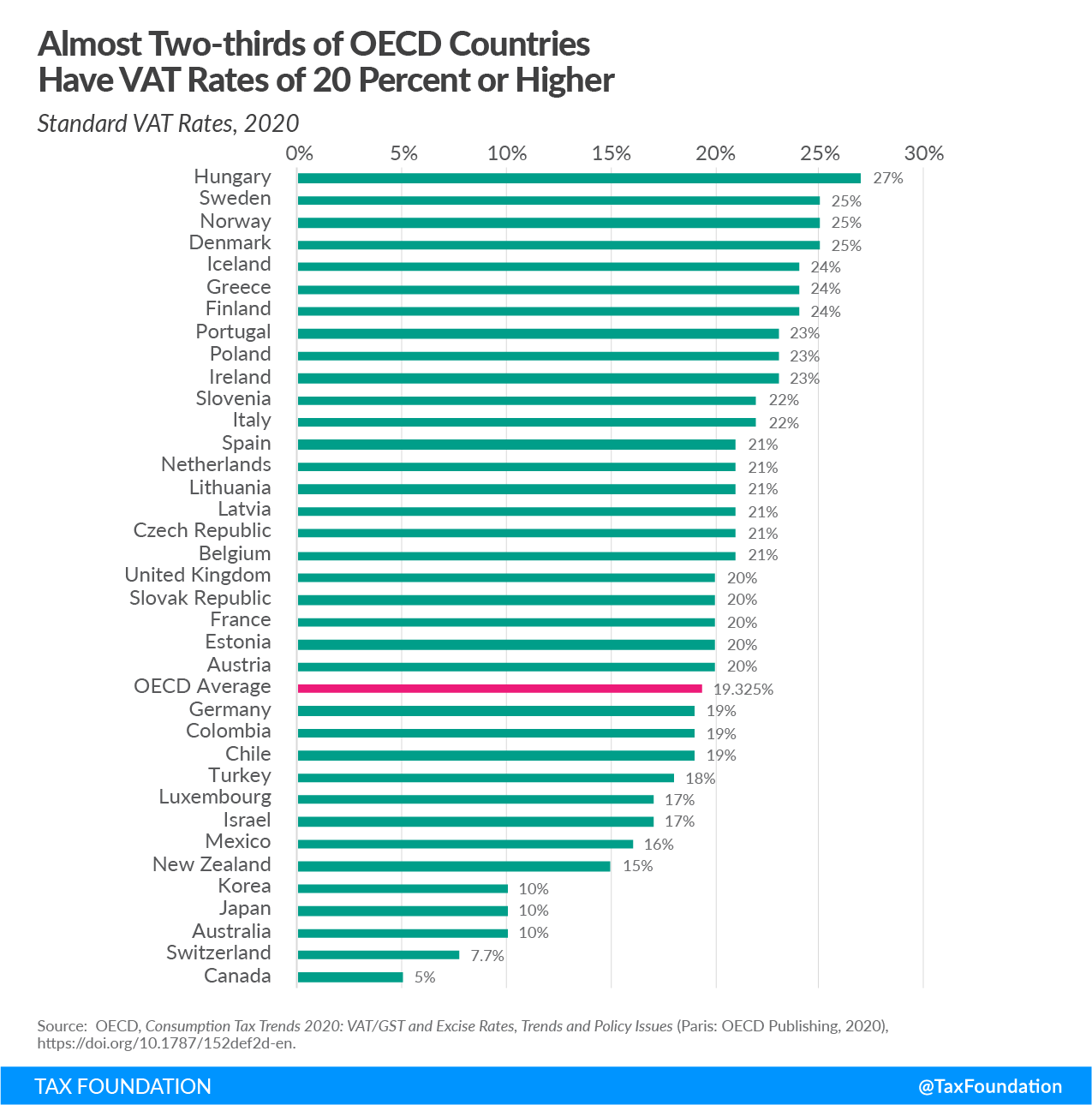

Consumption Tax Policies Consumption Taxes Tax Foundation

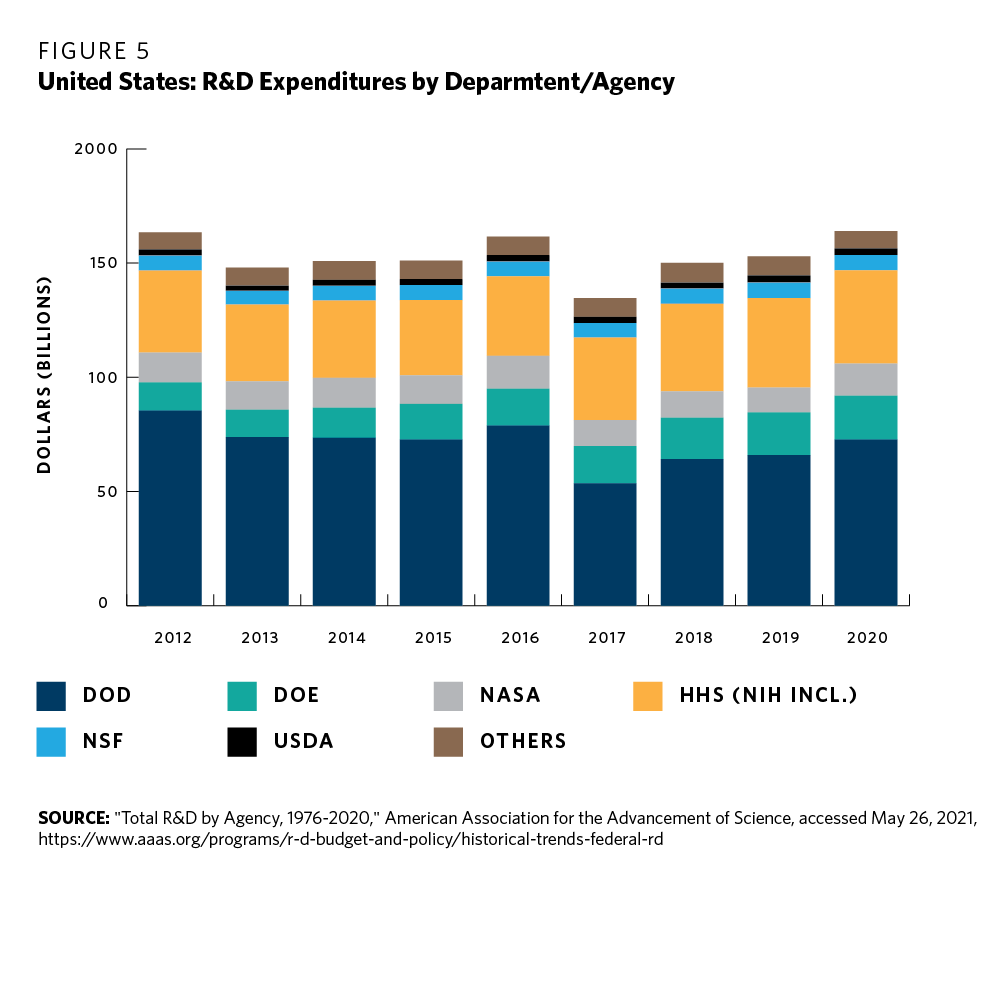

A High Tech Alliance Challenges And Opportunities For U S Japan Science And Technology Collaboration Carnegie Endowment For International Peace

Let S Talk About Us Tax Implications Of The Malta Treaty Htj Tax

Resource Html Uri Comnat Com 2021 0823 Fin Eng Xhtml Com 2021 0823 Fin Eng 01002 Jpg

Full Article The Rise Of China And Contestation In Global Tax Governance

Nonprofit Law In Japan Council On Foundations

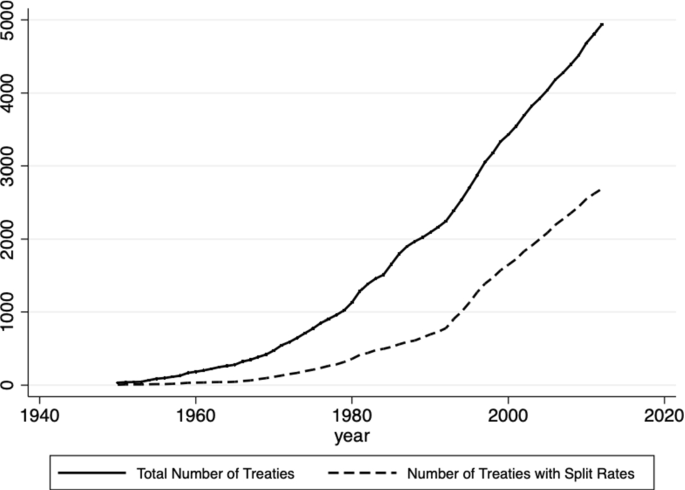

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

Us Tax Tips For American Expats Who Retire In Japan Bright Tax